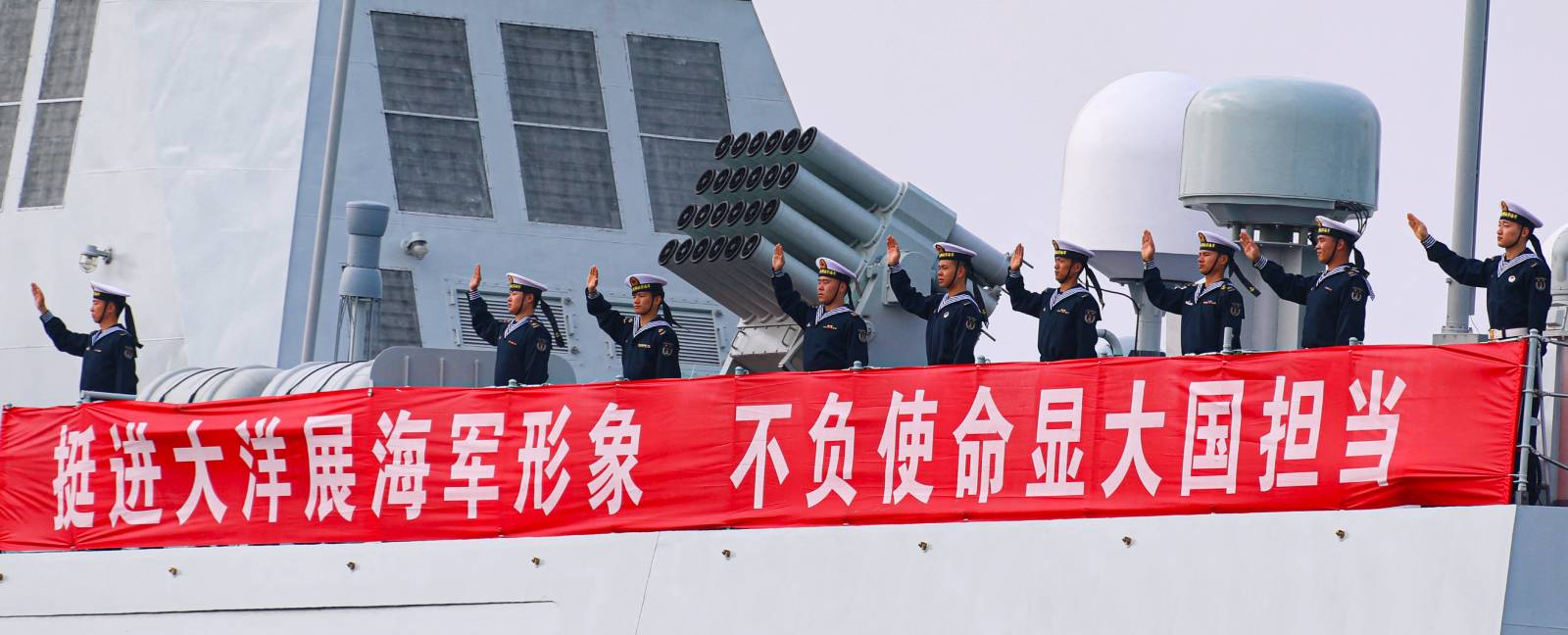

The 44th fleet of the Chinese People’s Liberation Army Navy on an escort mission to East Africa. (Photo: Fang Sihang/Xinhua/AFP)

Africa-China relations in 2025 kicked off with a trip to the continent by China’s Foreign Minister Wang Yi from January 5-11. Since 1991, China’s foreign minister has visited multiple African countries at the start of each year to mark the beginning of China’s Africa diplomatic calendar. The trip marks Wang’s 57th visit to Africa since 2013.

China’s Africa policy is part of a global strategy to create dependencies and interdependencies that make countries and regions more inclined to support China’s global ambitions.

Wang will be visiting Chad, the Republic of the Congo, Namibia, and Nigeria. Chad plays a key role in China’s effort to secure global supply chains of critical minerals in the high-tech and clean energy sectors. Congo-Brazzaville is the incoming African co-chair of the Forum on China-Africa Cooperation (FOCAC). Namibia is China’s major maritime partner on Africa’s Atlantic seaboard, where the largest concentration of China’s port developments are located. Nigeria represents Chinese expanded engagements in the Economic Community of West African States, which will inaugurate its new Chinese-built and financed headquarters in February 2025.

The tour follows the ninth FOCAC Summit in September 2024 and reinforces policy measures announced in June at China’s regular closed-door conclave or plenum that sets policy targets. China’s medium-term plan extending to 2029 seeks to expand what it calls “major country diplomacy,” a term China uses to describe its self-perceived status as a Great Power. It also seeks to boost China’s global supply chains and complete ongoing military modernization, among other priorities. African countries are central to accomplishing these targets.

Following are some issues to look out for in Afro-Sino relations in 2025.

Chinese Objectives

Implementing the FOCAC Beijing Action Plan (2025-2027)

FOCAC is China’s oldest, largest, and most regularized regional forum and one of the mechanisms China uses to expand its global influence. Its latest FOCAC Plan outlines 10 programs, from industrialization and expansion of Chinese free trade zones to police and military cooperation. The FOCAC meetings in September were followed by senior Chinese official visits to Kenya, Malawi, Seychelles, Tanzania, South Africa, and Zambia. In November, CCP General Secretary Xi Jinping visited Morocco to drum up support for FOCAC’s new program.

Chinese officials use these events to promote their governance model and align their policies with China’s.

In September, Beijing hosted the China-East African Ministerial Dialogue on Law Enforcement and Security Cooperation and a seminar on the China-Africa Peace and Security Forum for African military educators. In November, Uganda hosted the Sixth China-Africa Forum of Law School Deans. Chad held the China-Africa Think Tank Energy Forum in December. The People’s Liberation Army (PLA) Navy hosted West African defense chiefs in Shanghai for the Second Symposium on the Security Situation in the Gulf of Guinea, an area of increasing security interest to the CCP.

Chinese officials use these events to promote their governance model and work with counterparts to align their policies with China’s. In Uganda, African judicial officials and jurists looked at how Chinese and African laws could be harmonized to expand China’s One Belt One Road initiative, China’s global effort to create new trade corridors connected to its economy. In Chad, African and Chinese hydrocarbon officials and corporate executives discussed setting up renewable energy production and supply chains. The forum was hosted by a think tank of the China National Petroleum Corporation, which takes the lead in consolidating China’s energy-related global supply chains.

The FOCAC Beijing Action Plan (2025-2027) also recommits China and African countries to coordinate their positions in multilateral institutions. The Plan would continue mobilizing African participation in the alternative global institutional architecture that China has created over the past 20 years. African diplomatic support would likewise continue to be leveraged to support China at the United Nations (UN) and other multilateral bodies. The Plan also prioritizes implementing the Global Security Initiative (GSI), Global Development Initiative (GDI), and Global Civilization Initiative (GCI)—a trifecta of concepts underlying China’s effort to advance alternative global norms and practices.

Aligning FOCAC programs with African initiatives is a priority for African stakeholders.

While African countries generally seek to maintain cordial ties with China for the benefits this may bring, these initiatives aim to enlist African support for China’s effort to reshape global norms. African thought leaders regularly remind governments of the continent’s preference to avoid being pulled into competing blocs by instead seeking to diversify their strategic partnerships.

Securing Global Supply Chains

Africa is increasingly important to China’s effort to control global clean energy supply chains. Chinese firms account for 8 percent of Africa’s total mining output. This is substantially below that of Western firms. Anglo American mining alone accounts for more than double of that share. However, since 2019, China’s mine ownership in Africa has expanded by 21 percent. In 2024, Chinese firms made major mining acquisitions for copper in Botswana and Zambia, copper and cobalt in the Democratic Republic of the Congo (DRC), and lithium in Zimbabwe and Mali among other new ventures.

A processing facility in Kolwezi, DRC, belonging to Chinese company Zijin Mining. (Photo: Alamy)

China’s portfolio of port projects is critical to these supply chains. Chinese firms are involved in 62 African port projects: 33 in West Africa, 17 in East Africa, 9 in North Africa, and 3 in Southern Africa. Some of the significant Chinese state-owned enterprises’ initiatives in Africa in 2025 include renovating the 1,860-km Tanzania-Zambia (TAZARA) Railway that terminates at Dar es Salaam Port, operating the new container terminal at Egypt’s El Dekheila Port, operating Nigeria’s Lekki Deep Sea Port, and operating a terminal at Egypt’s Port of Abu Qir through an agreement with the Egyptian Navy.

Consolidating Political Party and Government Ties

Africa is the third most important region for China’s party-to-party work after Asia and Europe in terms of the frequency of high-level exchanges, study tours, and party-building to cultivate political and personal networks with decision-makers, influencers, and regime loyalists. The CCP’s International Department (CCP-ID) maintains ties with 130 African political and opposition parties, with different CCP party schools taking turns to train them.

The spread of CCP-funded African party and government schools and training programs is a development to watch in 2025.

The 2025-2027 FOCAC plan aims to train 1,000 African party officials and organize regular exchanges for parliaments and local governments. Since the FOCAC summit in September, the CCP-ID held exchanges with senior party and government leaders from Algeria, the Republic of the Congo, Egypt, Ethiopia, Kenya, Morocco, Rwanda, Seychelles, South Africa, Togo, Tunisia, Zambia, and Zimbabwe. African officials also attended 15 seminars at the Academy for International Business Officials (AIBO) within the Ministry of Commerce, China’s flagship institute for training foreign officials.

AIBO’s curricula systematically promotes the uptake of China’s governance methods. The learning objective for the “Seminar on Civil Servants for Developing Countries” reads as follows: “During the training, the development path of the Chinese people led by the CCP from ‘standing up,’ ‘becoming rich,’ and ‘becoming strong,’ will be introduced, in particular China’s remarkable achievements in economic and social developments in the last 40 years.”

The Chinese flag flies alongside those of Former Liberation Movements of Southern Africa member states outside the entrance to the Nyerere Leadership School. (Photo: screen capture)

The spread of CCP-funded African party and government schools and training programs is a development to watch in 2025. The Mwalimu Julius Nyerere Leadership School in Tanzania, Herbert Chitepo School of Ideology in Zimbabwe, CCP Central Party School, China-Africa Institute (CAI), Chinese Academy of Sciences (CAS), and provincial CCP schools all conduct this type of work in Africa. Some African ruling parties, particularly those preoccupied with regime survival, admire the CCP’s methods of absolute control, but pro-democracy movements view them as a danger to Africa’s democratization and are highly critical of China’s extensive party-building programs.

Advancing Chinese Military Modernization and Outreach

The PLA Navy’s 47th Escort Task Group (ETG) is set to arrive in the Gulf of Aden off the Somali coast in early 2025. It consists of the Type 052D guided-missile destroyer Baotou on its first deployment to Africa. The Type 054A Jiankai-class guided-missile frigate Honghe is also on its maiden African deployment. Two arriving naval helicopters and 700 PLA troops, including special forces, are expected to participate in China’s expanding military-training roster in Africa in 2025.

China’s expanding military education initiatives in Africa have raised concerns among pro-democracy advocates.

Chinese naval flotillas have been deployed continuously in Africa since 2008 and are China’s first overseas deployments outside the Western Pacific. They started as antipiracy missions and gradually incorporated sea- and land-based exercises, evacuation of Chinese nationals and those of friendly countries, naval port calls, and protecting sea lanes. The distances involved in these missions and their increasing complexity enable the PLA to use African maritime domains as a proving ground for “out-of-area operations.” China’s first overseas naval base in Djibouti and potential future dual use basing arrangements support this larger objective.

West Africa will likely feature more prominently in the PLA’s training schedule in 2025, given China’s interest to extend its patrols into the Gulf of Guinea, a region rich in minerals and expansive Chinese fishing operations. In 2025, China will launch a program to train 6,000 African senior officers and 500 junior officers and 1,000 law enforcement officers by 2027—a slight increase in the numbers it trained prior to the COVID pandemic. China’s military education is also designed to cultivate personal, professional, and political ties as well as promote China’s governance models, including party control of the military. Roughly one-third of China’s 37 professional military education institutions admit foreign students, mostly from Russia, Asia, Africa, and increasingly Latin America. Sometimes close to half of the students attending these schools are African.

China’s expanding military education initiatives in Africa have raised concerns among pro-democracy advocates criticizing China’s model of party control as setting a negative example for Africa’s next generation of military leaders. Most African constitutions require militaries to be apolitical and adhere to principles of democratic civilian control and service to the constitution and nation.

African Objectives

The top three items on the African agenda for relations with China in 2025 are market access, balanced trade, and value addition.

A FOCAC initiative announced last September allows 33 African countries to export 140 products into China tariff-free. However, major non-tariff barriers remain in place, from uneven quotas to complex customs procedures and administrative hurdles. Even if they are removed, African countries still export mainly unprocessed goods and commodities to China. This means large trade deficits will remain while trade volumes grow.

An emerging dimension of Africa-China relations is the growing relevance of independent African communities-of-interest in China.

African countries must enact structural and policy reforms to move up the value chain. However, for these to make a difference, corresponding measures from China will be needed, given its position as Africa’s largest trade partner. Some African leaders are seeking a Chinese policy commitment to reduce and eliminate the import of unprocessed African goods. Others want more targeted Chinese investments in African manufacturing. “We must stop exporting soil,” said Zambia’s Minister of Mines at a major conference for lithium producers in 2023.

Infrastructure remains a big ticket item for Africa in 2025, given the pledge at the FOCAC 2024 Summit by African countries and China to complete 30 cross-border infrastructure projects by 2027. How these will be prioritized, selected, and cofinanced is less clear, though. African governments have tapped the African Union development agency (NEPAD) to take the lead in coordinating responsibilities for these projects.

An emerging dimension of Africa-China relations is the growing relevance of independent African communities-of-interest in China. These thought leaders represent an expanding professional cadre of African expertise to advise African governments on China policy to foster more balance, awareness, and accountability in the Africa-China relationship.

Top objectives for these independent China watchers include:

- Establishing a system to track FOCAC commitments

- Promoting financial transparency, particularly in extractives

- Pushing for greater coherence in African strategies toward China

- Advancing new models for debt sustainability

Independent African communities of interest on China, for example, want to see a more empowered NEPAD that develops a system to track, monitor, and issue regular reports on FOCAC commitments.

These communities of interest have also proposed expanding a resource mobilization model that channels Chinese infrastructure finance through African multilateral financial institutions (AMFIs) like the African Development Bank. Doing so heightens transparency and the likelihood that Chinese-financed projects will benefit African citizen interests as AMFIs adhere to strict international lending standards. At the same time, it offers lenders a way to reduce their risk exposure.

Foreign students at the PLA Command College in Nanjing. (Photo: China.org.cn)

More closely aligning FOCAC programs with African initiatives like the AU’s Agenda 2063 and the Program for Infrastructure Development in Africa (PIDA) is also a priority for African stakeholders. While China trains more African professionals than other donors, questions are often raised about how much agency African countries have in designing these programs. Some African thought leaders suggest that the AU-aligned African Capacity Building Foundation (ACBF) should be involved in shaping these programs from design to implementation. The Africa-China Reporting Project at the University of the Witwatersrand similarly equips young African journalists with the expertise in Africa-China relations to elevate the depth of coverage of these issues.

The Chinese in Africa and Africans in China (CA/AC) Network is the world’s largest community of interest of its kind, with over 1,200 members engaged in regular cutting-edge research. An outcome of their efforts was the publication by the Institute for Global Dialogue of a comprehensive framework for an Africa strategy toward China, with chapters from Africa’s top specialists on China.

Finding Synergies within Divergent Objectives

China’s Africa policy is part of a global strategy to create dependencies and interdependencies that make countries and regions more inclined to support China’s global ambitions. African countries, in contrast, do not have a written strategy toward China. Yet, African interests are still discernible and, at times, not aligned with those of China. Measures of progress for 2025 will be whether momentum to clearly articulate African interests can be sustained, African ownership of Chinese-funded capacity building can be institutionalized, and a system to systematically track FOCAC commitments while maximizing benefits to the continent can be established.

Additional Resources

- Paul Nantulya, “The Growing Militarization of China’s Africa Policy,” Spotlight, Africa Center for Strategic Studies, December 2, 2024.

- Christian-Géraud Neema, “What FOCAC 2024 Reveals About the Future of China-Africa Relations,” Carnegie Endowment for International Peace,” November 21, 2024.

- Yun Sun, “2024 FOCAC Beijing Summit: A New Chapter?,” Brookings Institution, November 5, 2024.

- Paul Nantulya, “Reimagining African Agency in Africa-China Relations—Lessons from FOCAC 2024,” Spotlight, Africa Center for Strategic Studies, October 7, 2024.

- Patrick Anam and Hannah Wanjie Ryder, “Reimagining FOCAC Going Forwards: An African Assessment of Needs, Demands and Opportunities for FOCAC 2021 and Beyond,” Development Reimagined, November 2021.

- Philani Mthembu and Faith Mabera, eds., Africa-China Cooperation: Towards an African Policy on China? (London: Palgrave Macmillan, 2021).

More on: China in Africa