Click here for printable PDF version.

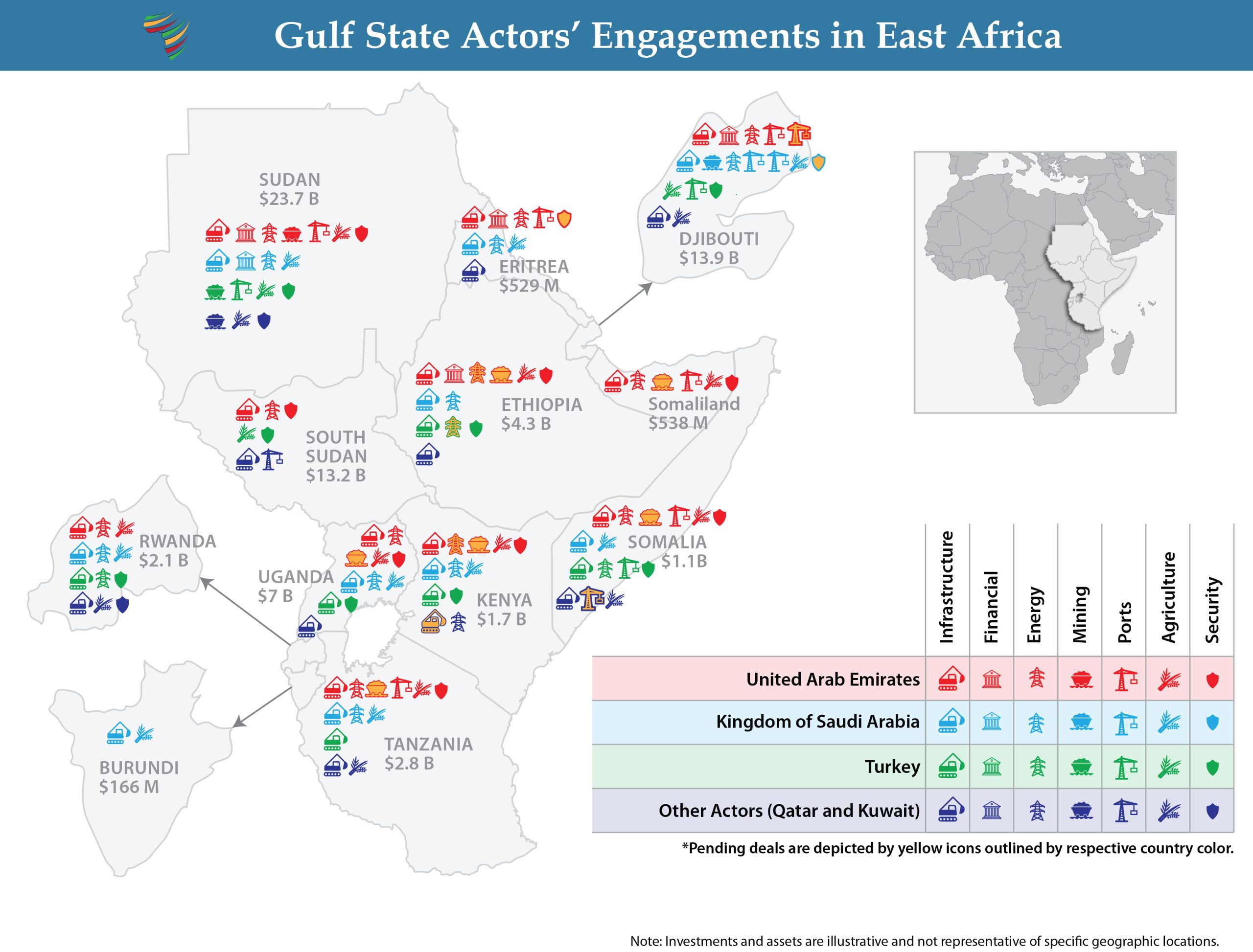

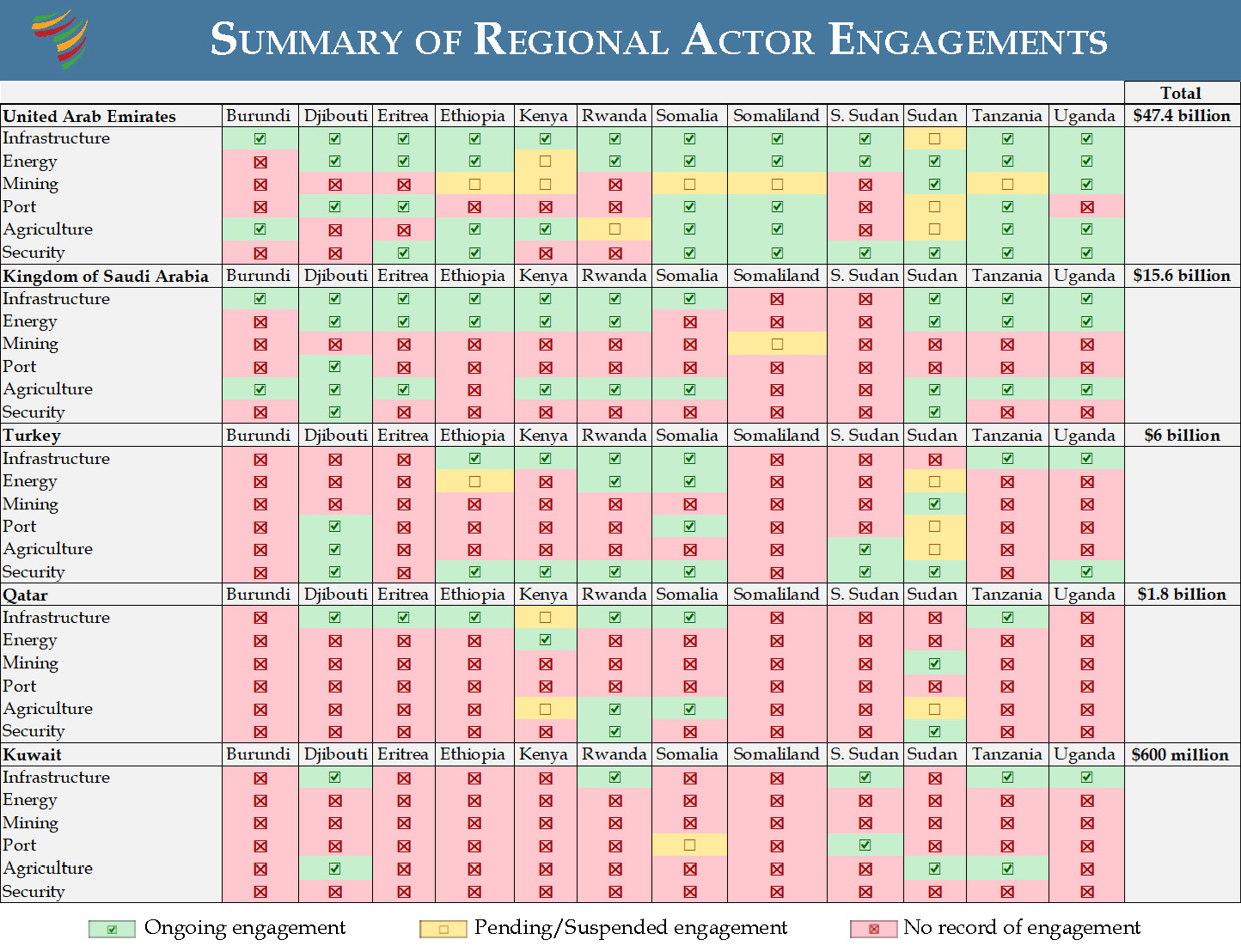

Driven by economic interests, rivalries, and ambitions to be a dominant regional power, the United Arab Emirates, the Kingdom of Saudia Arabia, and Turkey have become leading sources of capital, private sector engagement, and weapons flows into East Africa in recent years. Combined with heightened engagements from Qatar and Kuwait, this has amounted to roughly $75 billion in investments for East Africa in recent years. These Gulf states (and Turkey), thus, have become increasingly intertwined with the economies, port operations, politics, and security forces of East Africa—with far reaching implications for the region’s roughly 415 million citizens.

Gulf states and Turkey have become increasingly intertwined with the economies, port operations, politics, and security forces of East Africa.

These engagements highlight stark political and economic disparities between the regions. The median per capita income for Gulf state investors is 22-fold greater than that of the targeted East African countries. The East Africa region, moreover, has been wracked by instability with 9 out of the 12 countries in the region facing armed conflict. This fragility has, at times, been amplified by the Gulf states’ rivalries—seen most vividly in Sudan where regional actors are sponsoring opposing sides of the armed conflict.

To better understand the scale, focal points, and variations in the approaches of these regional actors, this review maps out the major reported investments and assets held by the respective actors by country and sector.

Highlights

- The United Arab Emirates (UAE) is by far the most engaged regional actor in East Africa with an estimated $47 billion in projects. This represents roughly 60 percent of all Gulf region capital inflows into East Africa and contributes to the UAE being the fourth largest source of capital in Africa, following the European Union, China, and the United States.

- The UAE is also distinctive for the breadth of its engagements—maintaining active investments in all 12 African jurisdictions in the region and across all 6 sectors considered—infrastructure, energy, mining, port development, agriculture, and security. Illustratively, the UAE is engaged across each of these sectors in Somalia, Somaliland, Sudan, and Tanzania.

- The UAE is by far the single largest investor among the regional actors in Sudan with an estimated $22 billion of non-security initiatives underway. This represents roughly 90 percent of all Gulf state investments in Sudan.

The United Arab Emirates is by far the most engaged regional actor accounting for roughly 60 percent of all Gulf region capital inflows into East Africa.

- Every regional actor considered has some level of economic engagement in Sudan, making it the East African country with the widest scope and volume of regional engagement. Underscoring the stakes, most are also reportedly supplying weapons to the combatants in Sudan, though concrete figures for these security commitments are not readily available.

- Saudi Arabia has an estimated $15.6 billion in investments across East Africa, largely concentrated in the energy, infrastructure, and agriculture sectors. Saudi Arabia is mostly absent in the security sphere, with the notable exceptions of Sudan and Djibouti.

- The locus of Saudi Arabia’s engagements in East Africa—both in value ($13 billion) and scope of investments—is Djibouti. Saudi investments account for approximately 90 percent of all Gulf state actor financial inflows in Djibouti, highlighting Riyadh’s vision of Djibouti as a gateway for expanded ties in East Africa.

- Djibouti is also noteworthy for the breadth of engagement from nearly every regional actor. With almost $14 billion in investments from Gulf state actors, Djibouti (population of 1.1 million) is the beneficiary of the highest level of per capita investment in East Africa, underscoring its strategic location on the Bab al Mandab Strait.

- Turkey is an increasingly significant actor in East Africa with investments across 9 of the 12 countries. Though located outside of the Gulf, Turkey’s engagements have manifested alongside those of the Gulf states. Tanzania, Ethiopia, Somalia, and Sudan are concentrations of Turkey’s engagement, with Turkey being the most active regional actor in Tanzania. Turkey is also distinctive for its security focus in East Africa with security initiatives in eight of the nine countries in which Turkey has engagements.

Click here for printable PDF version.

Gulf Actors

United Arab Emirates

Since the 2008-2009 global economic recession, the UAE has significantly reoriented its geopolitical strategy toward the African continent, particularly East Africa.

- Emirati engagements span every country in the East African region with the Abu Dhabi Fund for Development (ADFD) taking the lead on many of these investments.

- Sudan is the UAE’s leading target country in East Africa with approximately $22 billion in Emirati engagements (though many of these are suspended due to the conflict). This total represents roughly half of the UAE’s portfolio in East Africa and entails engagements across each of the six engagement sectors considered.

- South Sudan is the second largest recipient of Emirati investments, primarily focused on an oil agreement valued at $13 billion. Uganda is third with $6.6 billion of investments in the oil and gold refining sectors.

- This coincides with energy being the leading sector of Emirati investment in East Africa (with $19.3 billion in agreements), followed by agriculture ($11.9 billion), port development ($7.3 billion), and infrastructure ($5.9 billion).

The UAE has become one of the most active sponsors of security initiatives, including arms transfers, direct funding, and military cooperation, in East Africa.

- Although exact financial figures are not publicly available, the UAE has become one of the most active sponsors of security initiatives (arms transfers, direct funding, and military cooperation) in East Africa among the regional actors. The UAE is engaged in the security sector in 8 of the 12 countries in the region.

- Port infrastructure is a critical focus of Emirati strategy in East Africa, closely tied to DP World, the Emirates’ global port management company. Through DP World, the UAE has secured port development agreements in at least six countries, including Djibouti, Eritrea, Rwanda, Somalia, Somaliland, and Tanzania, with a deal pending in Sudan.

- The UAE depends on imports for 85 percent of its agricultural commodities, making food security a strategic priority. The UAE has become one of the largest foreign land buyers in Africa. In East Africa, Sudan has been the focal point of this agricultural interest, attracting $10.2 billion in Emirati investment.

| Total UAE Investments in East Africa | |

|---|---|

| Burundi | $6.3 million |

| Djibouti | $685 million |

| Eritrea | $189.5 million |

| Ethiopia | $2.3 billion |

| Kenya | $828.5 million |

| Rwanda | $78.8 million |

| Somalia | $612.9 million |

| Somaliland | $539 million |

| South Sudan | $13.0 billion |

| Sudan | $21.9 billion |

| Tanzania | $736.8 million |

| Uganda | $6.6 billion |

| Total | $47.4 billion |

| UAE Investments by Sector | |

|---|---|

| Sector | Value |

| Infrastructure | $5.9 billion |

| Energy | $19.3 billion |

| Mining | $2.7 billion |

| Port Development | $7.3 billion |

| Agriculture | $11.9 billion |

Sources: Investment and asset data generated from Abu Dhabi Fund for Development (ADFD) annual reports, DP World, DP World News, Masdar, Amea Power, Emirates News Agency, International Renewable Energy Agency, Africa Energy Portal, Chatham House, SIPRI, SIPRI US Department of Treasury, Yale University Humanitarian Research Lab Report; UN Panel of Experts Report DRC (’19); UN Panel of Experts Report – Sudan (’24),Center for Advanced Defense Studies, Egypt State Information Services, Rwanda Ministry of Agriculture, Djibouti Ports & Free Zone Authority, Gulf Research Center and other international and regional media outlets: 3ayin, AGBI, Africa Business, Africa Defense Forum, Africa News, AgriInsite, Al-Monitor, Arab News, Arab News Somaliland Report, Arabina Business, BBC, Bloomberg, Construction News, Critical Threat, Daily Monitor Uganda, Economy Middle East, Emirates News Agency, Emirati Streit Group, Embassy of Rwanda in UAE, Farmland Grab, Financial Times, France 24, Fresh Del Monte, FTL Somalia, Global Highways, Grain, Gulf Research Center, Human Rights Concerns in Eritrea, IPP Media-The Guardian, KenyansCo, LinkedIn, Logistics Update Africa, Madote Eritrea, Middle East Construction News, Nations, New Vision, Next is Africa, NS Energy, Pulse Uganda, Renewal Africa, Reuters, Saba Net, Solar Financed, Somali Dispatch, Somali Forum, Somaliland Reporter, Sudan Independent, Sudan Tribune, The Africa Report, The Citizen, The Citizens Co, The Independent, The Maritime Standard, The Reporter Ethiopia, The Wall Street Journal, UAE Times, and Zawya.

Notes:

Total investments and assets are derived from the amount reported by ADFD plus additional investment reports.

Financial value for some projects is not publicly available, which are not included in the total.

Value of suspended projects is incorporated in the total to represent the financial interests at stake.

Security sector support is listed based on publicly available information, though it is not exhaustive. Values are not included in the total.

Pending deals indicate signed agreements that have yet to be actualized. Values of these projects are not included in the total.

Kingdom of Saudi Arabia

- The Kingdom of Saudi Arabia (KSA) maintains a portfolio of an estimated $15.6 billion in investments in East Africa spread across 11 of the 12 countries in the region (with the exception of South Sudan).

- Saudi activities in East Africa are focused on the infrastructure sector where the KSA maintains a minimum of $100 million in investments and at least six ongoing projects in seven countries. This comprises a host of road, hospital, sanitation, and communications initiatives.

- The primary mechanism of the KSA’s investment in the region is the Saudi Development Fund (SDF). The KSA also provides funding and loans to African countries via the Islamic Development Bank, in which the KSA holds a 23.5-percent stake.

Saudi engagements are heavily concentrated in Djibouti. The $13 billion invested in Djibouti represents over 80 percent of the KSA’s commitments in the region.

- In terms of scale, Saudi engagements are heavily concentrated in Djibouti. The $13 billion invested in Djibouti represents over 80 percent of the KSA’s commitments in the region. The focal point of these investments is the $12.7-billion Djibouti Damerjog International Park refinery by the Aiyal Petroleum and Energy Company—slated to be one of the largest refineries in East Africa.

- Another pillar of KSA engagement in Djibouti is the creation of a Saudi Logistics City—a 120,000-square-meter facility with a 92-year lease that will provide a hub for Saudi commerce and trade with Djibouti and the region. The KSA is also negotiating for the establishment of a military base in Djibouti (also with a 92-year lease).

- Aside from Djibouti, the KSA has notably limited security sector engagements in the region (with the exception of Sudan where the KSA is reportedly an important financial backer of the Sudanese Armed Forces (SAF)).

| Total KSA Investments in East Africa | |

|---|---|

| Burundi | $160 million |

| Djibouti | $13 billion |

| Eritrea | $61 million |

| Ethiopia | $365 million |

| Kenya | $162 million |

| Rwanda | $168 million |

| Somalia | $93 million |

| Somaliland | N/A |

| South Sudan | N/A |

| Sudan | $1 billion |

| Tanzania | $105 million |

| Uganda | $403 million |

| Total | $15.6 billion |

| KSA Investments by Sector | |

|---|---|

| Sector | Value |

| Infrastructure | $2 billion |

| Energy | $13 billion |

| Mining | N/A |

| Port Development | $50 million |

| Agriculture | $433 million |

Sources: Data generated from Saudi Development Fund Annual Report and other international and regional media outlets, Djibouti Port and Free Zone Authority: Alarabiya, Arab News, Addis Insight, AGBI, All Africa, Business and Human Rights Resource Center, Dabanga Sudan, Facility for Talo and Leadership (FTL Somalia), Farm Grab, Financial Times, The Guardian, Horn Tribune, KP Press, Leaders MENA, Reuters, Somaliland Chronicles and WaryaTV.

Notes:

Total investment and assets are derived from the amount reported by SDF plus the additional investment reports.

Financial value for some projects is not publicly available, which are not included in the total.

Value of suspended projects is incorporated in the total to represent the financial interests at stake.

Security sector support is listed based on publicly available information, though it is not exhaustive. Values are not included in the total.

Pending deals indicate signed agreements that have yet to be actualized. Values of these projects are not included in the total.

Turkey

Turkey is engaged in nearly every sector in Somalia and Sudan.

- Turkey has a diversified portfolio of engagements across East Africa with active projects in 9 of the 12 countries totaling an estimated $6 billion in investments (excluding security). In five of these countries, Turkey’s investments exceed $500 million. This includes large railway projects in Ethiopia, Tanzania, and Uganda.

- Turkey is engaged in nearly every sector in Somalia and Sudan. In Somalia, Turkey’s engagements are distinctive in that it has taken on ownership roles, gaining significant stakes in the projects in which it is investing. In Sudan, Turkey has negotiated a 99-year lease of the Sawakin Port (50 kilometers south of Port Sudan) as well as various oil, gold, and mining deals.

- Turkey has differentiated itself among regional actors by its broad engagements in the defense sector with security initiatives underway in eight East African countries. This includes the deployment of troops, training, supporting military bases, helping to build the Somali navy, and the provision of materiel.

- Turkey has emerged as a leader in the unmanned aerial vehicle (UAV) market, controlling 65 percent of global UAV sales. This includes supplying 5 of the 12 countries in East Africa: Djibouti, Ethiopia, Kenya, Somalia, and Sudan. Negotiations are also underway for Turkey to establish an artillery and drone assembly plant in Uganda.

- Turkey has invested $4.5 billion in infrastructural projects in East Africa. Half of the countries in the region receive Turkish financial or technical support for projects such as the construction of roads and railways. Tanzania and Ethiopia have been the largest partners of these projects, each securing nearly $2 billion in Turkish infrastructural investments.

| Total Turkish Investments in East Africa | |

|---|---|

| Burundi | N/A |

| Djibouti | $20 million |

| Eritrea | N/A |

| Ethiopia | $1.7 billion |

| Kenya | $760 million |

| Rwanda | $520 million |

| Somalia | $220 million |

| Somaliland | N/A |

| South Sudan | $105 million |

| Sudan | $758 million |

| Tanzania | $1.9 billion |

| Uganda | $131 million |

| Total | $ 6 billion |

| Turkish Investments by Sector | |

|---|---|

| Sector | Value |

| Infrastructure | $4.5 billion |

| Energy | $450 million |

| Mining | N/A |

| Port Development | $870 million |

| Agriculture | $133 million |

Sources: Stockholm International Peace Research Institute (SIPRI), Policy Center for the New South, Chatham House-Gold and War in Sudan, Office of the Prime Minster of Somalia, Human Rights Watch, Future for Advanced Research & Studies, Anadolu Ajansi (AA), Atlantic Council, and other international and regional media outlets: Addis Standard, Africa Intelligence, Associated Press (AP) News, Capital FM, CGTN Africa, Construction Today, ConstructionHQ World, Daily Press, Daily Sabah, DAR Consultancy, Defense News, Defense Web, Deutsche Welle News (DW), DR Consultation, ENA Reliable News Source, Ethiopian Rail Cooperation, Fana Broadcasting Corporation, France 24, Garowe Online, Global Data Points, The Guardian, The Guardian (IPP Media), Habari Kenya, Hiiraan, Kenya Foreign Policy, KT Press, Logistics Business Africa, Military Africa, Nation Africa, Nations Africa, News Central Africa, Nordic Monitor, Pulse Uganda, Railway Supply, Reuters, Stadium D, Steel Radar, Sudan Now, Sudan Tribune, The Africa Report, The Guardian, TIKA, Turkiye Today, and Uganda Investment.

Notes:

Financial value for some projects is not publicly available, which are not included in the total.

Value of suspended projects is incorporated in the total to represent the financial interests at stake.

Security sector support is listed based on publicly available information, though it is not exhaustive. Values are not included in the total.

Pending deals indicate signed agreements that have yet to be actualized. Values of these projects are not included in the total.

Qatar

Qatar’s most financially significant engagement in East Africa is in Rwanda.

- Qatar’s most financially significant engagement in East Africa is in Rwanda, where Qatar Airways has committed $1.3 billion to the construction of the Bugesera International Airport (40 kilometers south of Kigali International Airport). Qatar Airways will have a 60-percent stake in the airport and is negotiating to acquire a 49-percent stake in RwandAir. These engagements represent three-fourths of Qatar’s investments in East Africa.

- Outside of Rwanda, Qatar has a diversified portfolio of engagements in East Africa with investments in 8 of the 12 countries. These commitments are almost exclusively in the infrastructure and agricultural sectors, including water, roads, hospitals, and municipal building projects. Qatar, moreover, has a pending 40,000-hectare agricultural project with Kenya in the Tana River Delta.

- Qatar is also a reported financial and materiel backer of the SAF in Sudan’s armed conflict.

Sources: Qatar Fund for Development, Qatar Fund, RelifeWeb,the African Union Program for Infrastructure Development (AU-PIDA), Chatham House, Food and Agriculture Organization (FAO), the Gulf Research Center, Ministry of Foreign Affairs Rwanda,Qatar Chambers, Qatar Fund; and other international and regional media outlets: Ahram, Al Jazeera, All Africa, Arab News, Arab Times, Ayin Network, Bloomberg, Chanzo, Doha News , Elsewedy Electric, ENA Reliable News Source, Fana, Farmland Grab, Financial Times, Gulf Times, Hiiraan, Monitor Uganda, New Vision, Qatar Mining, Qatar Tribune, Radio Tamazuj, Reuters, the Rwanda Embassy in Qatar, RwandainQatar, SONNA Somali National News Agency, Sudan Tribune, Tasnim News Agency, The Atlantic, The Conversation, The News Times, and Wardheer News.

Notes:

Financial value for some projects is not publicly available, which are not included in the total.

Value of suspended projects is incorporated in the total to represent the financial interests at stake.

Security sector support is listed based on publicly available information, though it is not exhaustive. Values are not included in the total.

Pending deals indicate signed agreements that have yet to be actualized. Values of these projects are not included in the total.

Sources: Kuwait Fund for Arab Economic Development (KFAED), RelifeWeb, African Union Program for Infrastructure Development (AU-PIDA), Chatham House, Food and Agriculture Organization (FAO), the Gulf Research Center, Ministry of Foreign Affairs Rwanda; and other international and regional media outlets: Ahram, Al Jazeera, All Africa, Arab News, Arab Times, Ayin Network, the Bank of Bahrain and Kuwait, Bloomberg, Chanzo, Daily , Doha News,, Elsewedy Electric, ENA Reliable News Source, Fana, Farmland Grab, Financial Times, Gulf Times, Hiiraan, Monitor Uganda, New Vision, Radio Tamazuj, Reuters, SONNA Somali National News Agency, Sudan Tribune, Tasnim News Agency, The Atlantic, The Conversation, The News Times, and Wardheer News.

Notes:

Financial value for some projects is not publicly available, which are not included in the total.

Value of suspended projects is incorporated in the total to represent the financial interests at stake.

Security sector support is listed based on publicly available information, though it is not exhaustive. Values are not included in the total.

Pending deals indicate signed agreements that have yet to be actualized. Values of these projects are not included in the total.

East African Countries

Burundi

The KSA is by far the largest Gulf state investor in Burundi, with approximately $160 million invested in the construction of roads, hospitals, and vocational institutions.

Djibouti

The KSA is also the leading Gulf state investor in Djibouti, committing roughly $13 billion. This is concentrated in a $12.7-billion oil refinery. Comprising 300 hectares with a projected capacity of 300,000 barrels per day, the refinery would be one of the largest in East Africa. This is accompanied by the creation and management of a major logistics hub as part of a 92-year lease within Djibouti’s International Free Trade Zone. The KSA has also invested in the development of the Djibouti City and Tadjourah Ports while negotiating for a military base in this geographically vital country bordering the Bab al Mandab Strait.

Djibouti International Free Trade Zone inauguration ceremony in 2018. (Photo: AFP/Yasuyoshi Chiba)

The UAE has approximately $685 million in infrastructure, energy, and port operations in Djibouti. This includes a 30-year contract signed with the UAE firm, DP World, in 2006 to build and manage the Doraleh Port, the country’s largest and most sophisticated. However, the government of Djibouti rescinded the agreement in 2018, claiming the contract violated Djibouti’s sovereignty. Pending resolution of the ongoing lawsuits, Doraleh has been operated by the government-owned Doraleh Container Terminal Management Company and China Merchants Port Holdings. The UAE, meanwhile, retains 90-percent ownership of the Horizon Djibouti Terminals liquid storage facility.

Turkey has been a leading regional security partner with Djibouti, providing military training and the supply of armored personnel carriers and TB2 drones.

Eritrea

Assab Port in Eritrea. (Photo: FilmFixers)

The UAE and KSA’s roles as guarantors of the peace agreement between Ethiopia and Eritrea in 2018 have served as a gateway to strengthening engagements with Eritrea. The UAE has invested an estimated $190 million in transportation and energy projects. The UAE also has a 30-year lease agreement for the use of Assab Port. The port served as a military base in the UAE’s and Gulf state efforts to push back against Houthi advances during the Yemen civil war. Although the UAE has reduced its military operations in Assab since 2021, it remains a focal point of military cooperation with Eritrea.

The KSA’s estimated $61-million engagement in Eritrea has been diversified across road, electricity generation, and agricultural projects.

Qatar has supported Eritrea through a $230-million national bank loan and road projects.

Ethiopia

With an estimated population of 130 million people and a dynamic economy, Ethiopia is an attractive partner for multiple Gulf state actors. The UAE has developed especially close ties with Ethiopia, having committed $2.3 billion in financial support, renewable energy, and infrastructure projects. This includes a $400-million project to construct the road network to the port of Berbera in Somaliland, part of land-locked Ethiopia’s effort to diversify its reliance on the ports of Djibouti, through which Ethiopia currently routes 90 percent of its trade. The UAE has also supported Ethiopia through arms sales, providing 30 new armored personnel carriers.

Awash-Weldiya railway project in Ethiopia, part of Turkey’s investment in the country. (Photo: Yapi)

Turkey is another significant regional actor with interests in Ethiopia. These have largely revolved around the $1.7-billion Awash-Weldiya railway project that aims to connect northern regions of Ethiopia with the Addis Ababa-Djibouti railway network. Turkey has similarly become a significant security partner in Ethiopia, signing a military cooperation agreement with Addis in 2021 during the conflict with Tigray. Turkey’s provision of drones to the Ethiopian government is considered to have played an instrumental role in turning back Tigrayan forces and leading to the ceasefire agreement of 2022. Turkey’s similarly close security ties with Somalia have made it a trusted mediator in navigating Somalia-Ethiopia tensions surrounding the latter’s efforts to establish port access in Somaliland.

The KSA is another active partner for Ethiopia, maintaining an estimated $365 million in investments for a host of roads, electricity, and water and sanitation projects.

Kenya

Kenya and Turkey Defence Industry Cooperation Agreement signing at the 2023 International Defense Industry Fair in Istanbul. (Photo: KFP)

The UAE is the leading Gulf state investor in Kenya with a focus on the $800-million Galana Kulalu irrigation project involving the leasing of 250,000 acres of farmland to three firms from the UAE. This initiative is being augmented by a pending $1-billion geothermal-powered data center co-financed by an Emirati AI firm, G42, and Microsoft. The UAE is also negotiating with Kenya to extend its Mombasa-Nairobi Standard Gauge Railway to Uganda and South Sudan. The Abu Dhabi Sovereign Wealth Fund, meanwhile, has a $500-million pending investment in Kenya’s mining sector.

Turkey’s engagement in Kenya has focused on its $760-million investment in the Naivasha Special Economic Zone in support of factories producing construction materials, paper products, and furniture. Turkey is also expanding its security partnership with Kenya to include the provision of drones and a pending deal for armored personnel carriers.

The KSA has a diversified set of engagements in Kenya entailing $164 million of road projects, health infrastructure, power plants, and agricultural sector support.

Rwanda

Qatar is the Gulf state with the largest monetary investment in Rwanda, with Qatar Airways committing $1.3 billion for the construction of the new Bugesera International Airport. Plans are for Qatar Airways to use Rwanda as a regional cargo hub.

Qatar Airways is scheduled to own a 49 percent share of RwandAir. (Photo: Turkana)

Turkey also maintains significant engagements in Rwanda, mostly in the construction of the Gisagara Thermal Power Station and various stadium renovation projects, totaling $520 million. Reflective of Turkey’s effort to position itself as a leading security actor in East Africa, Turkey has emerged as a major arms supplier to Rwanda providing 178 armored vehicles in recent years.

The KSA has invested an estimated $168 million across a host of projects in Rwanda, including road construction, hospital rehabilitation, and electrification initiatives.

The UAE’s investments in Rwanda are a relatively modest $79 million, encompassing infrastructural developments in water treatment facilities, off-grid solar systems, and road projects. However, the UAE is the primary destination of an estimated $885 million in annual gold exports from Rwanda. Much of this gold allegedly comes from the Democratic Republic of the Congo (DRC).

Somalia

Given its long coastline, strategic location, and port access on the Western Indian Ocean and Gulf of Aden, Somalia is the target of considerable attention from Gulf state actors, despite its nearly perpetual state of conflict since 1991.

The UAE has committed an estimated $613 million in Somalia across a range of port development and infrastructure projects. A locus of this has been the $336-million Boosaaso Port in Puntland and the Juba Sugar Factory in Jubaland, for which the UAE has provided $257 million in debt relief. With the discovery of gold in the contested territory between Puntland and Somaliland, the UAE has invested in the mining sectors of both jurisdictions. Many of the Emirati investments in Somalia are with the individual federal member states, primarily Puntland and Jubaland. Nonetheless, the UAE has also been an important source of military supplies, primarily armored personnel carriers, to the federal government in Mogadishu.

Turkey is Somalia’s most significant regional security partner. It maintains a military base in Somalia and provides military equipment, including attack helicopters, drones, and armored personnel carriers. Turkey also trains Somali forces, helps secure its coastline as part of a joint naval force, and provides intelligence support. Turkey, furthermore, has significant economic investments in Somalia, including an estimated $220 million in renovating the Mogadishu and Hobyo Ports. Turkish firms also manage the Aden Adde International Airport in which they retain an 87-percent share as part of a 20-year lease. Turkish firms are also involved in hydrocarbon exploration—in which they will receive 90 percent of the revenues to cover exploration costs.

A Somali boy holds a Turkish national flag during the festivities organized by the Somali government in Mogadishu for Turkish President Recep Tayyip Erdogan in 2023. (Photo: AFP/Hassan Ali Elmi)

Qatar ($200 million in infrastructural projects) and the KSA ($84 million in agricultural sector activities) are also significantly engaged in Somalia. Similarly, Kuwait is in the process of negotiating a deal to manage the Barawe Port in Southwest State.

Somaliland

The UAE is the only Gulf state actor with significant engagements in the self-declared independent state of Somaliland. These investments are focused in and around the Port of Berbera, for which DP World has negotiated a 30-year concession. This includes a $442-million investment to renovate and manage the port in which DP World has a 51-percent stake. In support of this, the UAE is upgrading the roads and facilitating a solar energy connection to the port. Further, the UAE has acquired land to support agriculture initiatives via its “banana belt” project.

Somaliland security personnel stand watch in front of shipping containers being stored at Berbera Port. Dubai-based port operator DP World and the Government of Somaliland opened a container terminal at Berbera Port in 2021. (Photo: AFP/Ed Ram)

The UAE is additionally engaged in strengthening security cooperation with Somaliland, including access to the Berbera naval base and airport.

South Sudan

The UAE dominates Gulf state engagements in South Sudan, the conflict-wracked country with the lowest per capita income in East Africa. This engagement centers around a $13-billion loan for infrastructural development from the privately owned Dubai-based Hamad Bin Khalifa Department of Projects. Negotiated in 2024, the loan is to be repaid over 20 years during which time the UAE will be able to purchase discounted oil from South Sudan. The loan amounts to double South Sudan’s GDP and five times its external debt, raising questions over the country’s ability to repay. The UAE has, thus, positioned itself as a central actor in South Sudan’s oil sector, which accounts for 90 percent of the country’s foreign revenue. Aside from the loan, the UAE has negotiated a memorandum of understanding to prospect for gold in South Sudan while supplying an estimated 320 armored personnel carriers to the government.

Kuwait has committed $120 million in South Sudan for the construction of the Juba Nile River Port, fisheries sector development, and hotel construction.

Turkey has supported a $105-million agro-industrial project in South Sudan as well as supplied materiel to the military.

Sudan

Sudan is the East African country that receives the greatest volume of financial interest by Gulf state actors amounting to roughly $24 billion in investments and assets, though many of these projects have been suspended due to the ongoing conflict. Sudan is also noteworthy in that there is engagement from nearly every regional actor.

A Sudanese man walks toward an Ilyushin Il-76 aircraft carrying supplies from the United Arab Emirates in 2023. (Photo: AFP/Giuseppe Cacace)

The UAE dominates these engagements, with nearly $22 billion in non-security commitments. The largest of these include a $10-billion investment in the management of 2.4 million acres of farmland by the Al-Dahra Agricultural Holding Company. This is augmented by UAE’s $5.7 billion of support to the Abu Amama Port on the Red Sea, approximately 200 kilometers north of Port Sudan. This is part of a larger set of Emirati-funded infrastructural investments to build up the infrastructure around the port.

The UAE is widely seen as being the primary financial backer of the paramilitary Rapid Support Forces (RSF) in the Sudan conflict as well as the leading source of materiel support, including vehicles, weapons, and drones.

The KSA is estimated to have invested $1 billion in Sudan. Most of this investment goes to agricultural and infrastructural projects, including irrigation schemes, dam and road construction, and rainwater harvesting. The KSA has also provided an estimated $250 million in financial support to help stabilize the Sudanese Central Bank. The KSA is reported to be providing financial and materiel support to the SAF in its conflict with the RSF.

Turkey is also heavily engaged in Sudan across the mining, energy, and port development sectors. The latter includes a $650-million engagement in the Sawakin Port on the Red Sea (roughly 50 kilometers south of Port Sudan), for which Turkey has secured a 99-year lease. Turkey is also reported to be an active supporter of the SAF, providing financing and materiel including weapons and drones. Turkey, moreover, is negotiating to establish a military base in Sawakin.

Tanzania

Gulf state engagement in Tanzania is marked by its breadth with every Gulf state in this review maintaining some investments in this country of 67 million people.

Turkey sponsors the single largest regional investment with a $1.9-billion loan from the Export Credit Bank of Turkey funding a portion of the Standard Gauge Railway project aimed at connecting the ports of Dar es Salaam with landlocked neighbors Rwanda, Uganda, and the DRC. The Turkish company, Yapı Merkezi, is leading the construction.

A new building of the Tanzania Standard Gauge Railway (SGR) terminus in Dar es Salaam. (Photo: AFP/Ericky Boniphace)

The UAE has approximately $740 million invested in Tanzania, spanning the infrastructure, energy, and agricultural sectors. Its largest investment is in port development. In 2023, DP World signed a 30-year, $250-million lease to manage two-thirds of the Dar es Salaam Port. In 2024, the UAE expanded its presence through a joint venture under the East Africa Gateway with Adani Ports (a subsidiary of India’s Adani Group), acquiring 95 percent of the shares in Tanzania International Terminal Services Limited. A further pending deal could see GSG Energies, an Emirati company, invest $500 million in Tanzania’s mining sector.

Uganda

Ugandan President Yoweri Museveni during the signing of a Memorandum of Understanding between the Government of Uganda and the Sharjah Chamber of Commerce and Industry from the United Arab Emirates. (Photo: Kikubo)

Gulf state engagements in Uganda are dominated by the UAE with roughly $6.6 billion in energy, mining, and infrastructure investments.

The UAE’s largest investment in Uganda is the $4.5-billion development of a 60,000-barrel oil refinery project financed by Alpha MBM Investments. The agreement provides the firm a 60-percent stake in the refinery with the Uganda National Oil Company holding the remaining 40 percent. The UAE is also the leading destination of Ugandan gold exports with an estimated $1.2-billion worth of gold exported annually from Uganda to the UAE. Given that Uganda has recorded limited gold exports until recently, speculation has mounted that much of this gold has been sourced in the DRC.

The Emirati-based STREIT Group also has undertaken a joint venture with the commercial wing of the Ugandan Ministry of Defence, the National Enterprise Corps, to establish an armored vehicle manufacturing plant in Uganda.

The KSA maintains over $400 million in investments in Uganda, mostly focused on infrastructure projects including the New Jinja Bridge project, roads, hospitals, and water supply initiatives.

Turkey’s Yapı Merkezi has secured a major contract to construct Uganda’s segment of the Standard Gauge Railway (SGR). This project, spanning 273 kilometers, aims to improve regional connectivity by linking cities across southern Uganda at an estimated cost of $3 billion (funded from Ugandan sources). Turkey, moreover, is actively engaged in Uganda’s security sector, supplying approximately $131-million worth of military vehicles. Turkey is also negotiating to establish an artillery and drone assembly plant in Uganda.