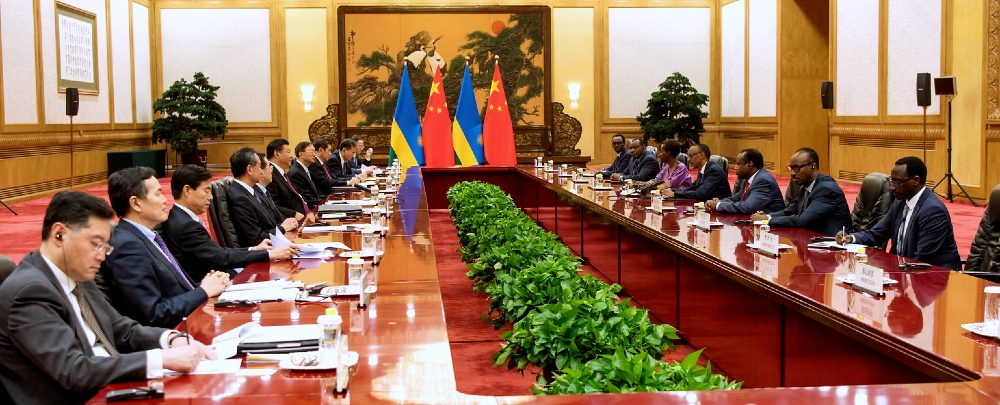

A meeting between Chinese and Rwandan delegations at FOCAC in 2018. (Photo: Office of the President of Rwanda)

The forthcoming Forum on China-Africa Cooperation (FOCAC) summit in Dakar, Senegal, confronts a relationship that is expanding but remains deeply asymmetrical. After 21 years of triennial summits, there is a widespread perception that China still benefits more from the relationship than its African partners. Africa maintains a structural annual trade deficit with China amounting to over $20 billion. With large-scale manufacturing largely absent, African countries continue importing expensive finished goods from China while exporting cheaper raw materials. African countries depend on Chinese firms and lenders to finance and build critical export infrastructure. Yet African firms face significant entry barriers to China’s value-added product markets relative to commodity exports.

Another persistent problem is that too often African elites harness Chinese largesse to build patronage networks, strengthen their political positions, and maximize self-enrichment. The lack of transparency in these deals is often detrimental to African citizens’ interests. Critical regulations regarding debt ceilings, environmental and labor standards, public oversight, and knowledge transfer are flouted, leaving the respective African nation in a perpetually weaker position relative to China.

“Pushback by African civil society is increasing and putting the relationship under more scrutiny.”

At the same time, pushback by African civil society is increasing and putting the relationship under more scrutiny as shown by the growth in recent media reporting, litigation, and protests targeting Chinese projects. Kenya’s loss-making Chinese-built Standard Gauge Railway (SGR) is a case in point. In June 2020, the Kenyan Court of Appeals declared the SGR contract illegal because it was not negotiated through a “fair, transparent, equitable, competitive and cost-effective” process—resulting in an unfavorable outcome for the public. While civil society engagement did not prevent Kenya from committing to the controversial deal, civil society organizations pushed for answers throughout the process, demanded more transparency, and launched multiple lawsuits.

FOCAC 2021 thus takes place in a context of growing questions over how Africa’s ruling elites manage their relationships with China. This is spurring growing calls to overhaul the partnership, including revisiting FOCAC’s institutional architecture.

Four Major Themes that have Shaped FOCAC in the Past Two Decades

A process rather than a mere series of summits. More African leaders choose to attend FOCAC than the UN General Assembly, the world’s largest summit. In 2018, 51 African presidents attended the FOCAC summit compared to just 27 at the General Assembly 2 weeks later. A central appeal of FOCAC is its focus on cultivating close partnerships (huǒbàn, 伙伴). Its agenda is negotiated quietly through dialogues at the ambassadorial, director-general, senior official, and ministerial levels, alternating between African and Chinese venues. Strategic priorities are laid down in 12 policy forums like the China-Africa Defense and Security Forum and the Ministerial Forum on China-Africa Health Cooperation. Technical organs like the China-Africa Local Government Cooperation Forum and the China-Africa Think Tanks Forum organize short-term training. Specialized think tanks within the Chinese government organize programs to give African recipients deeper exposure to China. The China-Africa Press Center, for example, offers 10-month fellowships for African journalists under the auspices of China’s foreign ministry.

Focus on training and capacity-building in Africa. FOCAC’s in-country training model consists of:

- multiyear programs for public servants with managerial and policy responsibilities

- mentorship programs linking African and Chinese institutions

- political party exchanges to train cadres and diffuse norms

- vocational education workshops

Roughly 50,000 training slots are distributed to African Union (AU) members across these 4 categories triennially. An additional 60,000 go toward educating civilian and military students, including several thousand at the leadership level. By 2020, China was providing more training for Africans than any other country, having overtaken India, Germany, Japan, and the United States.

A Chinese vocational workshop in Ethiopia.

(Image: Screen capture/Ethio Views)

These training programs are driven by Chinese institutions, however, leading to calls for giving Africans a greater role in designing programs meant for their benefit. Countries like South Africa have created binational commissions dedicated to leveraging FOCAC and shaping its institutions.

China’s cultural presence has also grown. In 2000, China had no cultural institutes in Africa and educated less than 2,000 African students. Presently, China has the second largest number of cultural institutes in Africa after France’s Alliance Française, having overtaken the British Council, Germany’s Goethe Institute, and the State Department’s American Centers, which have operated in Africa since 1883, 1934, and 1960, respectively. The number of African students studying in China has ballooned to 60,000, making China the top destination for English-speaking students.

Expanding China’s reach. In 2009, China displaced the United States as Africa’s largest trade partner, with total trade topping $200 billion in 2020. Chinese imports from Africa constitute between 20 to 30 percent of this trade volume and are dominated by crude oil and hydrocarbons, minerals, precious stones, and base metals. African imports from China consist of machinery, transport equipment, electronics, textiles, and footwear. These skewed trade patterns have led to calls for China to immediately remove tariffs on African value-added products as a means to increase the quality of Africa-to-China trade.

Investment in infrastructure and telecommunications. In 2000, China’s investment stock in Africa was just 2 percent of U.S. levels, with fewer than 200 Chinese firms on the ground. This soared to over 55 percent of U.S. levels by 2020, and the number of Chinese firms expanded to over 10,000, of which about 10 percent are state-owned. In construction alone, China’s state-owned firms have generated over $40 billion in revenues annually since 2012 in Africa. They finance one in five and build one in three projects, making China the single largest player in African infrastructure. Transport and energy infrastructure dominate Chinese foreign direct investment (FDI), along with utilities, technology, and real estate. Sixty-five percent of Chinese lending goes to these same sectors, making it difficult to neatly separate loans from investments.

The port of Mombasa, Kenya.

(Photo: Make It Kenya/Stuart Price)

Between 2000 and 2020, the Chinese portfolio included 46 port projects in Sub-Saharan Africa, one-third of Africa’s power grid and energy infrastructure, 186 government buildings, and 14 intragovernmental telecommunications networks. It is unclear how much of this is FDI and how much is debt-financed. However, over the same period, African countries signed 274 loans worth $46.6 billion for transport infrastructure, 174 loans for energy projects worth $38 billion, and 141 loans for communications and national security purposes worth $15.3 billion.

Many Africans are concerned that this borrowing, often subject to confidentiality clauses that bar borrowers from revealing their terms, will increase the risk of default and debt distress. In short, the past two decades of FOCAC collaboration have produced opportunities to expand training and infrastructure. However, these have tended to be dominated by elites, often on inequitable terms, which reinforce the asymmetrical nature of the relationship and increase African dependence.

Elevating African Agency

The Chinese partnership model prioritizes mutual dependency, reciprocal gestures, and networks (guānxi, 关系), meaning China must satisfy its partners—however weak—to accomplish its goals. Many African elites exploit this for self-serving ends. For example, entrenched regimes in resource-rich countries have long capitalized on China’s need for stable supplies to develop highly transactional relationships with Chinese actors who willingly finance African leaders’ pet projects in exchange for preferential access to resources and power brokers.

“Too often African elites harness Chinese largesse to build patronage networks, strengthen their political positions, and maximize self-enrichment.”

This has led to calls to broaden African agency in relations with China so that public interests are elevated. A case in point is the agreement signed by the AU and China in 2021 to align China’s Belt and Road strategy with Africa’s strategic blueprint known as Agenda 2063. This is a popular proposal that African think tanks lobbied the AU to table. Another example of African agency was the Economic Community of West African States’ (ECOWAS) creation of a single market vis-à-vis China in 2008 to increase ECOWAS’ leverage.

It should be recalled that the FOCAC enterprise itself was initiated by African countries to minimize the risk of being marginalized by the major powers after the Cold War. African initiative was also decisive in transforming it from a diplomatic initiative to a mechanism for development cooperation.

African agency is also being asserted bilaterally. For example, Ethiopia insisted on technology transfer and building a competent labor force as part of its negotiations with China Railway Group Limited for the 756-kilometer Ethiopia-Djibouti Railway. This included support for the African Railway Center of Excellence, a regional institute that trains rail engineers, including up to the masters and doctoral level. The railway is fully electrified and came at a cost of $3.4 billion. By way of comparison, Kenya’s Mombasa-Nairobi Standard Gauge Railway cost $3.2 billion, yet it is only partially electrified and covers 475 kilometers.

A platform at the Nairobi Terminus of the Standard Gauge Railway. (Photo: Macabe5387)

Kenyan civil society leaders blame corruption and lack of transparency for the government’s failure to secure better terms and ultimately default on the loan. Kenya cancelled the project in September 2020 to comply with the Kenya Court of Appeals’ ruling that the project was illegal and avoid more lawsuits. Kenya then demanded to take over operations of the railway. The Chinese operator, however, insisted on receiving 38 billion Kenya shillings (around $380 million) in unpaid bills before complying.

By contrast, in 2019 the Tanzanian government publicized the terms of the $10 billion Bagamoyo Megaport Project which it found “unacceptable” and “demeaning” including a provision for a 99-year Chinese lease and a commitment by Tanzania not to develop other ports. The Chinese partner accused the government of “misleading the public” but quickly tried to save face by accepting some of the counterproposals. With public opinion firmly against it and China’s image at risk, the Chinese returned to the table in June 2021.

These examples show that African partners can exercise agency and shape their relationships with China. In seeking to address this, leading African specialists on China met in Johannesburg in November 2018 to lobby South Africa to use its position as the incoming FOCAC co-chair to initiate a debate on a common African approach toward China to enhance African leverage. In 2021, they published a policy framework on a common position for the AU to consider, which among other things calls for better coordination, ethical leadership, and transparency.

Inside FOCAC 2021: Priorities for Africa

COVID-19 vaccine access will be a top priority for the AU. It is seeking commitments from China to open up production facilities to allow African countries to purchase vaccines. The African side is also mobilizing Chinese support for the AU’s ongoing effort to establish five vaccine manufacturing hubs across Africa. In July, Egypt started manufacturing the first Chinese COVID-19 vaccine in Africa through a partnership with Sinovac, a model the AU wants to replicate as part of a larger strategy to solve supply shortages.

Debt forgiveness will be a hard sell. Chinese lenders hold roughly 21 percent of African debt and extended loans worth $152 billion to 49 countries between 2000 and 2018. China fears setting a precedent for blanket forgiveness and will likely stick to debt restructuring and postponing repayments. At least 18 African nations are renegotiating debts with around 30 different Chinese lenders. A further 12 African countries are attempting to reschedule around $12 billion in loans. The ten countries with the largest Chinese debts are Angola ($25 bn), Ethiopia, ($13.5 bn), Kenya ($ 7.9 bn), Zambia (7.4 bn), the Republic of the Congo (7.3 bn), Sudan ($6.4 bn), Cameroon ($5.5 bn), Nigeria ($4.8 bn), Ghana ($3.5 bn), and Democratic Republic of Congo ($3.4 bn). After receiving partial debt forgiveness from China, Mozambique’s debt stands at roughly $2 bn.

Debt forgiveness will be a hard sell. Chinese lenders hold roughly 21 percent of African debt and extended loans worth $152 billion to 49 countries between 2000 and 2018. China fears setting a precedent for blanket forgiveness and will likely stick to debt restructuring and postponing repayments. At least 18 African nations are renegotiating debts with around 30 different Chinese lenders. A further 12 African countries are attempting to reschedule around $12 billion in loans. The ten countries with the largest Chinese debts are Angola ($25 bn), Ethiopia, ($13.5 bn), Kenya ($ 7.9 bn), Zambia (7.4 bn), the Republic of the Congo (7.3 bn), Sudan ($6.4 bn), Cameroon ($5.5 bn), Nigeria ($4.8 bn), Ghana ($3.5 bn), and Democratic Republic of Congo ($3.4 bn). After receiving partial debt forgiveness from China, Mozambique’s debt stands at roughly $2 bn.

It is unclear if some of the restructured debt will involve resource-for-infrastructure financing (RFI) or debt-equity swaps. In both scenarios borrowers risk forfeiting strategic assets, effectively putting their sovereignty at risk. African observers are warning that China would be courting a public relations disaster if it went down this road.

Negotiating increased infrastructure financing will be complicated as China’s infrastructure lending and FDI in Africa may slow over the mid-term due to the growing number of borrowers unable to repay their debts.

The problems of commodity dependence, non-tariff barriers, and trade deficits will also feature in the Dakar discussions. Despite its stated commitments to diversify, China imports little beyond commodities, and its markets for finished African products remain difficult to access, a problem that requires major policy reforms on the Chinese side.

On the African side, greater efforts are needed to expand opportunities for technology-intensive manufacturing. A notable exception is the tiny island nation of Mauritius. In 2020, it became the only African country to negotiate a free trade agreement with China, granting it duty-free access for 8,000 value-added products. This is a game changer that could grow Mauritius’ high-tech industries, create high paying jobs, and set an example for others. This took several years of tough and disciplined negotiations by Mauritius, however, which simultaneously negotiated a similar agreement with India. China was compelled to offer concessions that have eluded other countries.

“China wants to expand its ‘low-cost, low-risk, and high-yield’ security strategy in Africa.”

Negotiations over security and military cooperation will be more straightforward. China wants to expand its “low-cost, low-risk, and high-yield” security strategy in Africa given its growing interests and the security dimensions of the Belt and Road. In the process, China is steadily increasing its security presence (and leverage) and is keen to consolidate its engagements in peacekeeping, military education and professionalism, and military sales and exercises. Moreover, the China-Africa Peace and Security Fund, a special facility created in 2015 to operationalize the African Standby Force, is up for discussion and will likely be extended to 2024.

On the sidelines of the FOCAC summit, independent voices are also conveying their priorities given the impact these policies have on ordinary citizens, namely that:

- African governments must be accountable to their citizens for their engagements with China, especially on financial decisions.

- Public concerns should be considered in all negotiations such as environmental rights, debt sustainability, respect for local regulations, and labor laws.

- African countries should be more strategic, for instance, by leveraging their engagements with China to support the AU’s six continental frameworks: agriculture; infrastructure; mining; science, technology and innovation; intra-African trade; and industrial development.

Transforming FOCAC

China views Africa as place of economic and geostrategic opportunity despite the risks and wants to integrate Africa into China’s global strategy to restore itself as a “Great Power” (shì jiè qiáng guó; 世界强国). By contrast, African countries have not articulated a clear strategy, leading to growing calls for better coordination based on national, regional, and continental priorities. The expanding role of independent African actors, likewise, shows that Africa-China relations are not the exclusive domain of governments.

African citizens are calling on governments to revisit FOCAC’s architecture by expanding its existing mechanisms to reflect African inputs, establishing their own institutions within the partnership, and pushing China to undertake reforms to make it more equitable.

Opening ceremony of the 2018 FOCAC summit. (Photo: Présidence de la République du Bénin)

African voices are, moreover, pushing harder for accountability, transparency, and better oversight. While they largely welcome more Chinese investment and capacity building, they remain concerned that key aspects of the Africa-China relationship remain personalized and secretive, and therefore prone to corruption.

While it takes two to tango, African citizens are attempting to assert agency on their governments by demanding that they set and stick to the rules that Chinese actors must uphold. While in a much more dominant position, China can ill-afford to ignore these realities given how acutely sensitive it is to its image and how its intentions are perceived and characterized, particularly among developing countries. For FOCAC to deliver for African citizens, both African and Chinese leaders must be held accountable to prioritize citizen interests and be compelled to demonstrate transparently how all agreements undertaken at FOCAC are doing so.

Additional Resources

- Development Reimagined, “From China-Africa to Africa-China: A Blueprint for a Green and Inclusive Continent-Wide African Strategy towards China,” Special Report, June 2021.

- Paul Nantulya, “Reshaping African Agency in China-Africa Relations,” Spotlight, Africa Center for Strategic Studies, March 2, 2021.

- Philani Mthembu and Faith Mabera (eds.), Africa-China Cooperation: Towards an African Policy on China? (London: Palgrave MacMillan, 2020).

- Paul Nantulya, “Implications for Africa from China’s One Belt One Road Strategy,” Spotlight, Africa Center for Strategic Studies, March 22, 2019.

- Folashade Soule, “How to Negotiate Infrastructure Deals with China: Four Things African Governments Need to Get Right,” The Conversation, January 3, 2019.

- Oscar M. Otele, “Rethinking African Agency within China-Africa Relations through the Lens of Policy Transfer: A Framework for Analysis,” The African Review Vol. 43, No. 1, University of Dar-es-Salaam (2016).

- Aleksandra Gadzala (ed.), Africa and China: How Africans and Their Governments are Shaping Relations with China (London: Rowman & Littlefield, 2015).

- Tatiana Carayannis and Nathaniel Olin, A Preliminary Mapping of China-Africa Knowledge Networks (New York: Social Science Research Council, January 2012).

More on: Regional and International Security Cooperation China